Fx options volatility

By John Summa , CTA, PhD, Founder of OptionsNerd. Some of the blame for this lack of understanding can be put on the poorly written books on this topic, most of which offer options strategies boilerplate instead of any real insights into how markets actually work in relation to volatility.

However, if you're ignoring volatility, you may only have yourself to blame for negative surprises. In this tutorial, we'll show you how to incorporate the "what if" scenarios regarding changing volatility into your trading.

FX options sentiment | husoxupowoj.web.fc2.com

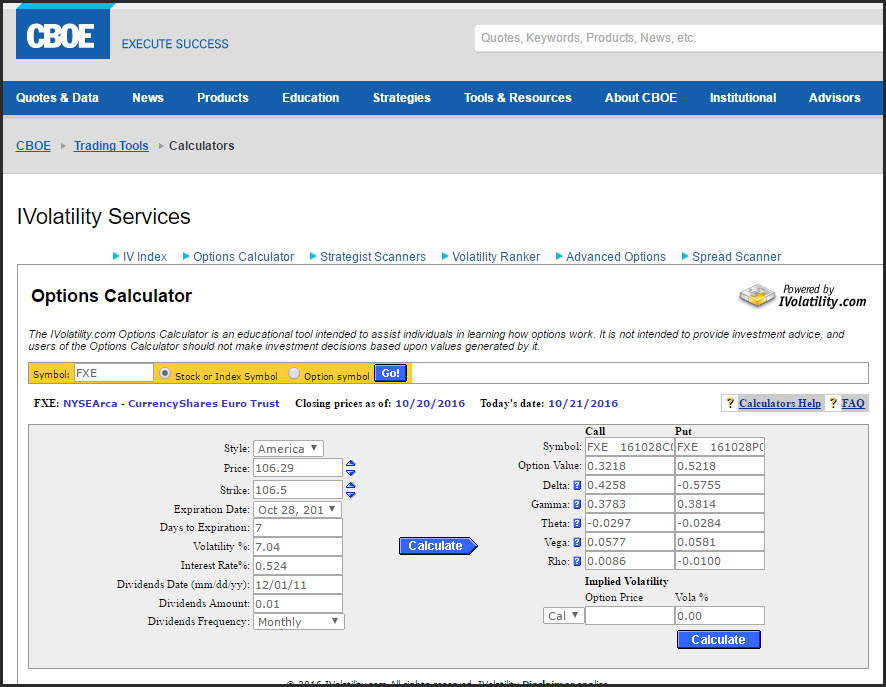

Clearly, movements of the underlying price can work through Delta the sensitivity of an option's price to changes in the underlying stock or futures contract and impact the bottom line, but so can volatility changes. We'll also explore the option sensitivity Greek known as Vega , which can provide traders with a whole new world of potential opportunity. Many traders, eager to get to the strategies that they believe will provide quick profits, look for an easy way to trade that does not involve too much thinking or research.

Option Volatility

But in fact, more thinking and less trading can often save a lot of unnecessary pain. That said, pain can also be a good motivator, if you know how to process the experiences productively. If you learn from your mistakes and losses, it can teach you how to win at the trading game.

This tutorial is a practical guide to understanding options volatility for the average option trader. This series provides all the essential elements for a solid understanding of both the risks and potential rewards related to option volatility that await the trader who is willing and able to put them to good use.

For background reading, see The ABCs Of Option Volatility. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Option Volatility By John Summa Share. Why Is It Important?

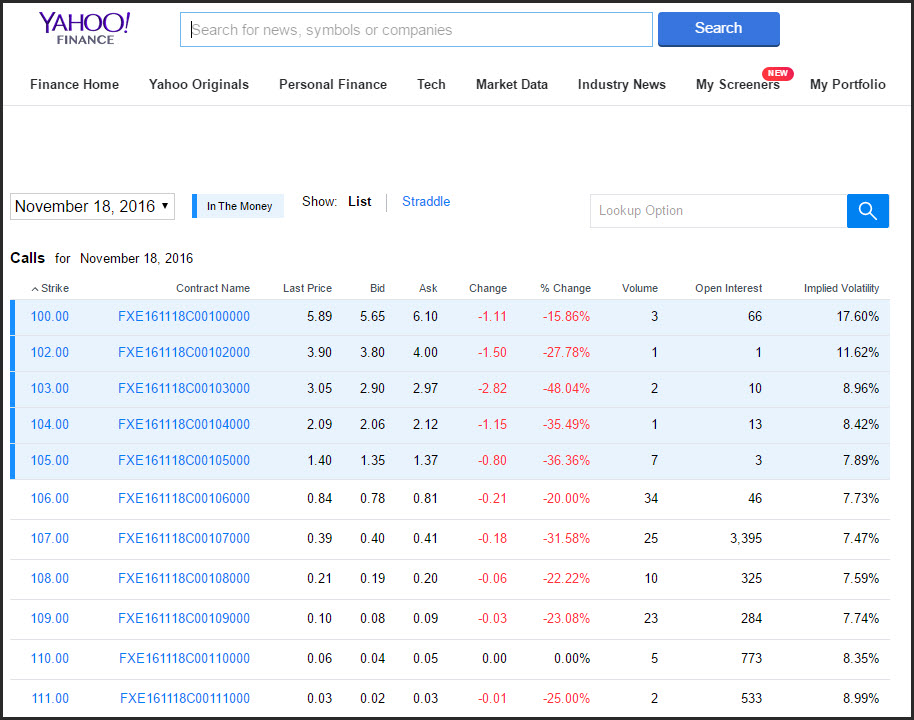

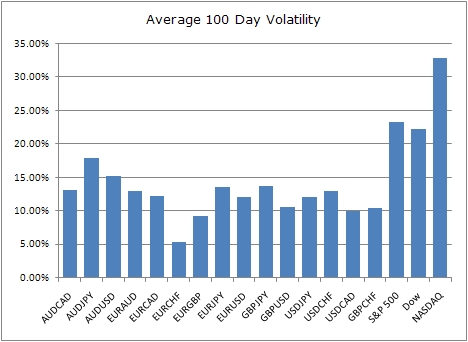

Historical Volatility Options Volatility: Projected or Implied Volatility Options Volatility: Strategies and Volatility Option Volatility: Vertical Skews and Horizontal Skews Option Volatility: Predicting Big Price Moves Option Volatility: Contrarian Indicator Options Volatility: A thorough understanding of risk is essential in options trading.

So is knowing the factors that affect option price. Find out how you can use the "Greeks" to guide your options trading strategy and help balance your portfolio. Discover the differences between historical and implied volatility, and how the two metrics can determine whether options sellers or buyers have the advantage.

You may participate in both a b and a k plan.

However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars. Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.