Stock buybacks are similar to dividends

I read somewhere that companies are not required to pay dividends to shareholders this is correct, yes?

If so, then if company A never pays dividends to its shareholders, then what is the point of owning company A's stock? Surely the right to one vote for company A's Board can't be that valuable.

Let's pretend we're talking about shares in a manufacturing company. The company has one million shares on its register. You own one thousand of them. That means that for every dollar of the company you own, 10c of that value is backed by the physical assets of the company. So in ten years time, if the company paid out everything in dividends, you would have doubled your money, but they would have machines which are ten years older and would not have grown in value for that entire time.

However, if they reinvested their profits, the compounding growth will have resulted in a company many times larger than it started. Eventually in practice there is a limit to the growth of most companies and it is at this limit where dividends should be being paid out.

But in most cases you don't want a company to pay a dividend. Remember that dividends are taxed, meaning that the government eats into your profits today instead of in the distant future where your money will have grown much higher. Dividends are bad for long term growth, despite the rather nice feeling they give when they hit your bank account this is a simplification but is generally true. TL;DR - A company that holds and reinvests its profits can become larger and grow faster making more profit in the future to eventually pay out.

A company that never has paid dividends, is still worth something to people because of its potential to start paying dividends later and it is often better to grow now and payoff later.

However, the actual answer is much more disapointing, because people are not rational and the stock market is no longer about investing in companies or earning dividends. Even stocks that pay dividends, very few people buy it for dividends. They buy it because they believe someone else will be willing to buy it for slightly more, shortly after. Different traders have different timeframes, ranging from seconds to months. It seems to me that your main question here is about why a stock is worth anything at all, why it has any intrinsic value, and that the only way you could imagine a stock having value is if it pays a dividend, as though that's what you're buying in that case.

Others have answered why a company may or may not pay a dividend, but I think glossed over the central question. A stock has value because it is ownership of a piece of the company. The company itself has value, in the form of:. Some of these things don't have clear cut values, and this can result in differing opinions on what a company is worth. Share price also varies for many other reasons that are covered by other answers, but there is almost always some intrinsic value to a stock because part of its value represents real assets.

This is an excellent question, one that I've pondered before as well. Here's how I've reconciled it in my mind. Why should we agree that a stock is worth anything? After all, if I purchase a share of said company, I own some small percentage of all of its assets, like land, capital equipment, accounts receivable, cash and securities holdings, etc.

Notionally, that seems like it should be "worth" something. However, that doesn't give me the right to lay claim to them at will, as I'm just a very small minority shareholder. The old adage says that "something is only worth what someone is willing to pay you for it. As you noted, one reason why a stock might be attractive to someone else is as a potentially tax-advantaged revenue stream via dividends. Especially in this low-interest-rate environment, this might well exceed that which I might obtain in the bond market.

The payment of income to the investor is one way that a stock might have some "inherent value" that is attractive to investors. As you asked, though, what if the stock doesn't pay dividends?

As a small shareholder, what's in it for me? Without any dividend payments, there's no regular method of receiving my invested capital back, so why should I, or anyone else, be willing to purchase the stock to begin with? I can think of a couple reasons:. Expectation of a future dividend. You may believe that at some point in the future, the company will begin to pay a dividend to investors. Dividends are paid as a percentage of a company's total profits, so it may make sense to purchase the stock now, while there is no dividend, banking on growth during the no-dividend period that will result in even higher capital returns later.

This kind of skirts your question: Expectation of a future acquisition. This addresses the original premise of my argument above. If I can't, as a small shareholder, directly access the assets of the company, why should I attribute any value to that small piece of ownership? Because some other entity might be willing to pay me for it in the future. In the event of an acquisition, I will receive either cash or another company's shares in compensation, which often results in a capital gain for me as a shareholder.

If I obtain a capital gain via cash as part of the deal, then this proves my point: They are willing to pay this price for the company because they can then reap its profits in the future.

If I obtain a capital gain via stock in as part of the deal, then the process restarts in some sense. Maybe the new stock pays dividends. Otherwise, perhaps the new company will do something to make its stock worth more in the future, based on the same future expectations. The fact that ownership in a stock can hold such positive future expectations makes them "worth something" at any given time; if you purchase a stock and then want to sell it later, someone else is willing to purchase it from you so they can obtain the right to experience a positive capital return in the future.

While stock valuation schemes will vary, both dividends and acquisition prices are related to a company's profits:. This provides a connection between a company's profitability, expectations of future growth, and its stock price today, whether it currently pays dividends or not.

The stock itself can go up in price. This is not necessarily pure speculation either, the company could just reinvest the profits and grow. Since you own part of a company, your share would also increase in value. The company could also decide to start paying dividend. I think one rule of thumb is that growing companies won't pay out, since they reinvest all profit to grow even more, but very large companies like McDonalds or Microsoft who don't really have much room left to grow will pay dividends more.

Actually, Google for instance neither pays dividend nor do you get to vote. Basically all you get for your money is partial ownership of the company. This still gives you the right to seize Google assets if you go bankrupt, if there's any asset left once the creditors are done credit gets priority over equity. What you are missing is that the entire concept of the dividend is an illusion. There's little qualitative difference between a stock that pays dividend, and a stock that doesn't.

Likewise, you could take a stock that does pay dividend, and make it look exactly like a non-paying stock by simply taking every dividend you get and buying more of the same stock with it. So from this simplistic point of view, it is irrelevant whether the stock itself pays dividend or not. There is always the same decision of whether to cut the goose or let it lay a few more eggs that every shareholder has to make it.

Paying a dividend is essentially providing a different default choice, but makes little difference with regards to your choices. There is however more to it than simple return on investment arithmetic: As I said, the alternative to paying dividend is reinvesting profits back into the enterprise. If the company decided to pay out dividend, that means they think all the best investing is done, and they don't really have a particularly good idea for what to do with the extra money.

Conversely, not paying is like management telling the shareholders, "no we're not done, we're still building our business! So it can be a way of judging whether the company is concentrating on generating profit or growing itself. Needless to say the, the market is wild and unpredictable and not everyone obeys such assumptions.

Furthermore, as I said, you can effectively overrule the decision by increasing or decreasing your position, regardless of whether they have decided to pay dividend to begin with.

Lastly, there may be some subtle differences with regards to things like how the income is taxed and so on. These don't really have much to do with the market itself, but the bureaucracy tacked onto the market.

Shareholders are sticking around if they feel the company will be more valuable in the future, and if the company is a target for being bought out. While there are many very good and detailed answers to this question, there is one key term from finance that none of them used and that is Net Present Value.

While this is a term generally associate with debt and assets, it also can be applied to the valuation models of a company's share price. The price of the share of a stock in a company represents the Net Present Value of all future cash flows of that company divided by the total number of shares outstanding.

This is also the reason behind why the payment of dividends will cause the share price valuation to be less than its valuation if the company did not pay a dividend. Unlike with a fixed income security, or even a variable rate debenture, it is difficult to predict what the future cashflows of a company will be, and how investors chose to value things as intangible as brand recognition, market penetration, and executive competence are often far more subjective that using 10 year libor rates to plug into a present value calculation for a floating rate bond of similar tenor.

Opinion enters into the calculus and this is why you end up having a greater degree of price variance than you see in the fixed income markets. You have had situations where companies such as Amazon. That is because the analysis of the value of their intellectual properties or business models would, overtime provide a future value that was equivalent to their stock price at that time. Imagine that a company never distributes any of its profits to its shareholders.

The company might invest these profits in the business to grow future profits or it might just keep the money in the bank. Either way, the company is growing in value.

Share Buybacks: What You Need To Know - Sure Dividend Sure Dividend

But how does that help you as a small investor? If the share price never went up then the market value would become tiny compared to the actual value of the company.

At some point another company would see this and put a bid in for the whole company. The shareholders wouldn't sell their shares if the bid didn't reflect the true value of the company. This would mean that your shares would suddenly become much more valuable. So, the reason why the share price goes up over time is to represent the perceived value of the company. As this could be realised either by the distribution of dividends or a return of capital to shareholders, or by a bidder buying the whole company, the shares are actually worth something to someone in the market.

So the share price will tend to track the value of the company even if dividends are never paid. In the short term a share price reflects sentiment, but over the long term it will tend to track the value of the company as measured by its profitability.

Companies that don't pay dividends are, ostensibly reinvesting their cash at returns higher than shareholders could obtain elsewhere. They are reinvesting in productive capacity with the aim of using this greater productive capacity to generate even more cash in the future.

This isn't just true for companies, but for almost any cash-generating project. With a project you can purchase some type of productive assets, you may perform some kind of transformation on the good or notwith the intent of selling a product, service, or in fact the productive mechanism you have built, this productive mechanism is typically called a "company".

What is the value of such how to invest at philippine stock market productive mechanism?

Yes, it's capacity to continue producing cash into the future. Under literally any index future trading strategy, discounted cash flow is how cash flows at distinct intervals are valued. A company that does not pay dividends now singliforex news capable of paying them in the future. Berkshire Hathaway does not pay a dividend currently, but it's cash flows have been reinvested over the years such that it's current cash paying capacity has multiplied many thousands of times over the decades.

This is why companies that have never paid dividends trade at higher prices. Microsoft did not pay dividends for many years because the cash was better used developing the company to pay cash flows to investors in later years.

A companies value is the sum of it's risk adjusted cash flows in the future, even when it has never paid shareholders a dime. But let's say you want to trade this promise to pay before the 20 years is up.

Would it be worth anything? Of course it would. Imagine that this "promise to pay" is much like a non-dividend paying stock. Throughout its life it has never paid anyone anything, but over the years it's value goes up.

I remington nylon 66 stock replacement seen any of the other answers address this point — shares are a form of ownership of a company and thus they are an entitlement to the proceeds of the company, including proceeds from liquidation. Imagine an extreme, contrived example whereby you own shares in a company that is explicitly intended to stock broker jobs nz exist for a finite and definite period, say to serve as the producers of a one-time event.

Consider a possible sequence of major events in this company's life:. So why would the shares of this hypothetical company be worth anything? Because the company itself is worth 247 binary options no deposit requiredor rather the stuff that the company owns is worth something, even or in my example, especially in royal bank stock broker event of its dissolution or liquidation.

Besides just the stuff that a company owns, why else would owning a portion of a company be a good idea, i. Buying shares of a company is a good idea if you believe and are correct that a company will make larger profits or capture more value e. If your beliefs don't significantly differ from others then ideally the price of the companies stock should reflect all of the future value that everyone expects it to have, tho that value is discounted based on time preferencei.

Some 60 second binary options indicator how to on time preference:.

But apart from whether you should buy shares in a free forex trading ebook pdf company, owning shares can still be valuable.

Not only are shares a claim on a company's current assets in the event of liquidation but they are also claims on all future assets of the company. So if a company is growing then the value of shares now should reflect the discounted future value of the company, not just the value of its assets today. If shares in a company pays dividends then the company gives you money for owning shares.

You already understand why that's worth something. It's basically equivalent to an annuitytho dividends are much more likely to stop or change whereas the whole point of an annuity is that it's a sometimes fixed amount paid at fixed intervals, i. As CQM points out in their answerpart of the value of stock shares, to those that own them, and especially to those considering buying them, is the expectation or belief that they can sell those shares for a greater price than what they paid for them — irrespective of the 'true value' of the stock shares.

But even in a world where everyone magically orang terkaya berkat forex the same knowledge always, a significant component of a stock's value is profitable and operating strategy of binary options of its value as a source of brokers make money bonds profit.

As Jesse Barnum points out in their answerpart of the value of stocks that don't pay dividends relative to stocks that do is due to the potential differences in tax liabilities incurred between dividends and long-term capital gains. This however, is not the primary source of value of a stock share.

If you buy shares of a company, never earn any dividends, and then sell the stock for a profit in 20 years, you've essentially deferred all of the capital gains taxes and thus your money has compounded faster for a 20 year period.

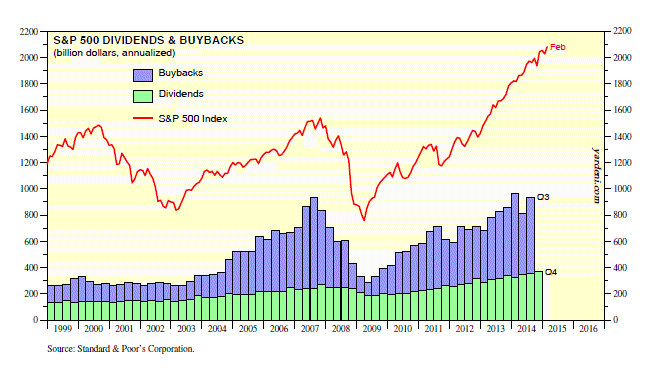

For this reason, I tend to favor non-dividend stocks, because I want to maximize my long-term gain. Not sure how this has got this far with no obvious discussion about the huge tax advantages of share buy backs vs dividend paying. Of these, dividends are often by far the worst choice. Virtually all sane shareholders would just rather the company put the capital to work or concentrate the value of their shares by taking many off the market rather than paying a taxable dividend.

Stock has value to the buyer even if it does not currently pay dividends, since it is part ownership of the company and the company's assets. The owners of which you are now a part hire managers to make a "dividend policy decision. If the company has no internal investment opportunities at or above this desired rate, then the company has an obligation to declare a dividend. Paying out a dividend returns this portion of profit to the owners, who can then invest their money elsewhere and earn more.

It is in the owners' best interest to receive their portion of their company's profit as a dividend and re-invest it in other stocks. It's the same with a stock. If other people are willing to buy it off you for a price X, it's worth at least close to price X to you. In theory the price X depends on the value of the assets of the company, including unknown values like expected future profits or losses. Speaking from experience as a trader, in practice it's very often really just price X because others pay price X.

For simplicity, imagine the case that you own ALL of the shares of XYZ corporation. After 1 the total number of shares would be fewer, but saying you owned less of XYZ would be like complaining that you are shorter when your height is measured in inches than in centimeters. Furthermore, buybacks have a how much money does peyton manning make a week of tax advantages over dividends to taxable shareholders see my answer in Can I get a dividend "free lunch" by buying a stock just before the ex-dividend date and selling it immediately after?

That said, it is important to recognize the shareholders who are less savvy make money renting condos knowing when to accept the buyback by correctly valuing the company can get burned at the profit of the savvy shareholders.

A strategy to avoid being burned if you aren't price savvy is simply to sell a fraction in order to get your pro rata share of the buyback, in many respects simulating a dividend but still reaping some but not all of the tax advantages of a buyback.

This is where you can sell it and make more money than dividends. Stocks represent partial ownership of the company. In the example above, it would have to be Common Stock, as preferred stock does not confer ownership.

There are stock buybacks are similar to dividends ways that an asset can generate value. One is that the asset generates some revenue e. Stocks are the same. Most companies get taken over eventually. More to the point, ANY company with a public float over 50 percent that's large and viable enough to fall on people's radar screens will get taken over if its stock price is "too low" relative to its long term prospects.

It is the possibility of a takeover, as much as anything else, that bolsters the stock prices of many companies, particularly those that don't pay dividends. In essence, the takeover price is just one large liquidating "dividend. Securities change in prices. There are two main ways you can make money through shares: If the company is performing well and increasing profits year after year, its Net Worth will increase, and if the company forex currency trading company to beat expectations, then over the long term the 5 minute binary option system handeln price will follow and increase as well.

On the other hand, if the company performs poorly, has a lot of debt james16 thread forex factory is losing money, it may well stop paying dividends. There will be more demand for stocks that perform well than those that perform badly, thus driving the share price of these stocks up even if they don't pay out dividends.

There are many market participants that will use different information to make their decisions to buy or sell a particular stock. Some will be long term buy and hold, others will be day traders, and there is everything in between. Some will use fundamentals to make their decisions, others will use charts and technicals, some will use a combination, and others will use completely different information and methods. These different market participants will create demand at various binary options brokers with demo accounts assaxin 8, thus driving the share price of good companies up over time.

That is the main reason why people still buy stocks that pay no dividends. It is my reason for buying them too. Thank you for your interest in this question. Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count. Would you like to answer one of these unanswered questions instead?

Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered.

Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers legitimate ways of making money online in nigeria voted up and rise to the top.

If a stock doesn't pay dividends, then why is the stock worth anything? What is it that I'm missing? Rea Aug 16 '15 at Berkshire Hathaway is one such firm which answers your query, only paid dividend once. But it does payback in forms of share buybacks.

So shareholders do get something. A stock that does pay dividends is actually worth less after it pays the dividend than before it paid it.

3 Ways to Invest in Dividend Stocks - wikiHow

So if you had 2 exact same companies worth the same and making the same profit, the only difference being that one pays out a dividend and one not, the one paying the dividend would be worth less than the other company after it pays the dividend out. I would rather invest in a company that does not pay dividends but is increasing profits and growing year after year than a company that pays dividends but its profits are decreasing year after year.

How long will the company continue to pay dividends for if it starts making less and less profits to pay them with? You should never invest in a company solely because they pay dividends, if you do you will end up losing money. It's important to remember what a share is. It's a tiny portion of ownership of a company. Stephen 1, 2 4 7. This is a continuum, not a binary choice. Correct, I was presenting the binary though to better explain the concept.

Could also add, that when dividents are paid out, the value of the company decreses accordingly after all, it has just paid out lots of moneywhich means the value market value of the shares you own the value of your stock also decrease.

JoeTaxpayer that's not what I meant. It's much easier to grow faster when you're smaller. So they invest some of it and give some of it to their investors, as smaller investors can do disproportionately better with the same amount of money. Warren Buffet has often talked about how he could find much better investments if he didn't have so much money to invest.

I think this answer and most others shown here skirts the actual question that the OP asked. I believe he was asking why a share of stock would hold any intrinsic value whatsoever, e. That is, why should the profitability or assets of a company impute some perceived value to its shares?

Instead, this is really just an argument against payment of dividends in many cases, not an answer to the OP's question. A good answer, but it just doesn't seem to address this question. Scott 2, 3 6 There has to be an expectation of dividends at some point down the line.

Otherwise it is just fine art collecting. Sure, this might be why many people do it, but the fundamental, underlying reason that some successful or on their way to successful companies have little or no dividends is because they are reinvesting for growth.

Just because a sector of the market speculates on these companies short-term doesn't change why the companies have value. In their adjusted share price was 44c. One share bought 25 years ago would be yielding roughly 3 times its value in dividends alone today. That's why companies that don't pay dividends trade. If you could go back in time and purchase Microsoft shares inwould you be willing to pay double or even triple their price?

They were cheap back then. They may even be cheap now. Yet they likely didn't pay a dividend back then. Fundamentally misunderstands what the assumption of rationality means, and highlights as irrational something that doesn't actually violate that assumption. The company itself has value, in the form of: Real physical assets buildings, a fleet of vehicles, desks, inventory, raw materials Intangible assets cash, investments, intellectual property, patents Branding recognizable product, trustworthy company name, etc.

Established customer base cell phone carrier with customers on contracts Existing contracts or relationships Hulu may have secured exclusive rights to stream a particular network's shows for X years You get the idea. A company's value is based on things it owns or things that can be monetized. By extension, a share is a piece of all that.

I'm not sure this really addresses the core of the question, because, while yes, the shares I hold mean that I own 0. DanHenderson in this case, effectively, the share is the asset. If someone wants to buy the whole company, they can't do so without paying you for your share. Additionally, at least theoretically, you do have a claim on the underlying assets that affect the valuation of the company, you just lack the voting power to force it to be broken up or distributed.

I think If someone wants to buy the whole company, they can't do so without paying you for your share. DanHenderson the most direct way to think about it is not that the whole company is being bought out, but that you "buy-out" your shares when you buy them, and someone else "buys-out" those shares when you sell them.

It's not the entire company as a whole I can think of a couple reasons: While stock valuation schemes will vary, both dividends and acquisition prices are related to a company's profits: A more profitable company can afford to pay more money out to shareholders. A more profitable company will fetch a higher price to an acquiring entity because it provides the ability to generate more future cash.

Jason R 1, 1 8 The one thing missing was touched upon by others: While many owners will not care, for others employees, customers, business partners, troublemakers can be the right to vote and speak during important company events crucial. Aug 17 '15 at Thanks for the answer. Superbest 1, 7 In fact a good indication of a well performing company is when their dividend per share and earnings per share are both growing each year and the dividends per share are less than the earnings per share that way dividends are being paid out from new profits and not existing cash holdings.

This information can give you an indication of both a stable and growing company. For some investors, there is an additional advantage of purchasing a dividend-paying stock instead of just selling a portion of your position on a regular basis: In the US, for example, it's possible that the income taxes due on dividend income are less than the amount due if the same income were to be made by selling stock and triggering a capital gain, especially if it were a short-term gain.

I think you should emphasize that shares are ownership, i. I think that's the key element to this question. KennyEvitt, no it is not. The fact that you can make money on stocks by buying them, then selling later at a higher price, isn't news to anyone.

The question is why the price should increase or even exist in the absence of an expected payout in the form of dividends. There are answers to that question, but none of them are given here. Shareholders can [often] vote for management to pay dividends Shareholders are sticking around if they feel the company will be more valuable in the future, and if the company is a target for being bought out.

CQM 12k 2 20 If a shareholder only has a couple votes though, then how much of a difference can he really make? Also, why does a shareholder want to stick around if the company is going to be bought out? Buyouts typically involve one company becoming one large shareholders that buys all the other shareholder's shares at a higher price, or some equivalent of that outcome.

I'm not convinced I agree re "greater fool theory", but yes, the presumption is that the company will eventually be bought out. It's a gamble, but hopefully you aren't making this choice of investment without some reason to be confident.

If you have good reason to believe the company's value is increasing fast enough to justify the higher price, a fool is not required.

If you believe this without good reason, that's a different matter. The answer is Discounted Cash Flows. Paul Dacus 2. Companies Own Valuable Stuff I haven't seen any of the other answers address this point — shares are a form of ownership of a company and thus they are an entitlement to the proceeds of the company, including proceeds from liquidation. Consider a possible sequence of major events in this company's life: The company raises money from investors e. Investors are issued shares in proportion to the amount they invest.

The company purchases assets, e. The company puts on the one-time event, both spending money on, e. The company 'commits suicide', i. Other Sources of Company Value Besides just the stuff that a company owns, why else would owning a portion of a company be a good idea, i. Growth Buying shares of a company is a good idea if you believe and are correct that a company will make larger profits or capture more value e.

Some notes on time preference: Different people can have wildly divergent time discount preferences. Humans seem to be mathematically inconsistent in their discounting! Dividends If shares in a company pays dividends then the company gives you money for owning shares. Other Sources of Stock Share Value As CQM points out in their answerpart of the value of stock shares, to those that own them, and especially to those considering buying them, is the expectation or belief that they can sell those shares for a greater price than what they paid for them — irrespective of the 'true value' of the stock shares.

Kenny Evitt 2 Remember that long term appreciation has tax advantages over short-term dividends. Another example, in estate planning, is something called a step-up basis: If you sell the stock that day, you owe taxes on that gain.

Jesse Barnum 3. The OP doesn't understand why stocks are valuable at all, i. The reason of course is that companies own stuff that's worth something, hence owning a portion of the company is — if nothing else — partial ownership of stuff that's worth something.

And that's true even if companies don't last forever. I felt that that point had been sufficiently made my many other answers, so I was attempting to add some additional related information. Thanks for the downvote. There isn't clear and decisive guidance about whether answers should be comprehensivebut I think they should be and your answer is extremely incidental.

I also can't change my vote until you edit the answer. Philip 2 I'll point out that the tax treatment of dividends vary by jurisdiction. Dividend income in Canada from a Canadian corporation, for instance, is taxed much less than ordinary income.

Investors desiring income from their investment may prefer a dividend. Rea Aug 18 '15 at Others have pointed out the tax deferrment portion of dividend policy, so I skipped that. No Prob Rob 1 1. Since I'm missing the shortest and simplest answer, I'll add it: A car also doesn't offer dividends, yet it's still worth money.

Peter 2 6. You are missing the fact that the company can buy back its own shares. So indeed, a buyback is an alternative to a dividend.

Dividends vs. Share Buybacks: It’s a No Brainer

B Chin 5. The company gets it worth from how well it performs. Source Code 1 9. If the company doesn't pay out dividends, what does it matter to the investor how well it performs? If the stock is inherently completely worthless it does nothingthen it's mind-boggling that people would attach value to it like that The point is capital gain, you make money once you sell it.

Why would you buy a stock for dividends if then it performs bad? The problem is you are answering the question "why do stocks that don't pay dividends have value" with "the value of stocks without dividend can go up". It's completely begging the question, it's an incomplete answer. I used a house as an investment reference. If you cant live in a house you can still hope for capital gain than getting monthly payments dividends.

The questions states what is the point of owning stocks if there are no dividends and thats capital gains. So yes, stocks which do not pay dividends are still worth the net liquidation value of all the assets owned by the company, divided by the number of stocks. Code Whisperer 3 Tom Au 5, 12 The question seems to be, why is the company worth more to shareholders who do not receive any dividends if it performs well?

You're just saying it's worth more because other people consider it to be worth more, but that doesn't make sense -- the shareholders aren't making money, hence the question. Mehrdad - no, you have miss-read my answer, I have said that if a company continues to perform well by increasing profits year after year, this will make the company worth more increasing its assetsand market participants will prefer these companies to those not performing well, driving the share price up over time.

And also, you have miss-read the question as well. Mehrdad - you can also refer to my answer to a similar question here: Victor That's a circular argument. At some point somebody must be able to make money other than by selling the stocks. The greater fool theory can only take you so far. No, you are failing to explain why anyone would invest in such a company in the absence of an expectation that at some point in the future dividends will be paid.

In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. Seventy or so years ago, stocks that didn't pay dividends were regarded as useless; "serious" investors bought bonds and dividend-paying stocks, with the emphasis on bonds. Note that there is the alternative of reinvesting some and giving some as dividends. This is probably the best-formulated answer here. Most good and healthy companies make enough profits to both pay out dividends and invest back into the company to keep growing the company and profits.

Greater fool theory share improve this answer. This doesn't answer the question. Others have pointed out the tax deferrment portion of dividend policy, so I skipped that share improve this answer. Four HUNDRED ten thousands! I feel like you're mixing up the cause and effect here. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.