How to read a call option chain

An option is a financial derivative that represents a contract sold by one party the option writer to another party the option holder. The contract offers the buyer the right, but not the obligation, to buy call or sell put a security or other financial asset at an agreed-upon price the strike price during a certain period of time or on a specific date exercise date. Traders use options to speculate, which is a relatively risky practice, while hedgers use options to reduce the risk of holding an asset.

In terms of speculation, option buyers and writers have conflicting views regarding the outlook on the performance of an underlying security. Call options give the option to buy at certain price, so the buyer would want the stock to go up.

Conversely, the option writer needs to provide the underlying shares in the event that the stock's market price exceeds the strike due to the contractual obligation. An option writer who sells a call option believes that the underlying stock's price will drop relative to the option's strike price during the life of the option, as that is how he will reap maximum profit. This is exactly the opposite outlook of the how to read a call option chain buyer. Macd stock market charts buyer believes how to read a call option chain the underlying stock will rise; if this happens, the buyer will be able to acquire the stock for a lower price and then sell it for a profit.

However, if the underlying stock does not close above the strike price on the expiration date, the option buyer would lose the premium paid for the call option. Put earning big money gta online give the option to sell at a certain price, so the buyer would want the stock to go down.

The opposite is true for put option writers.

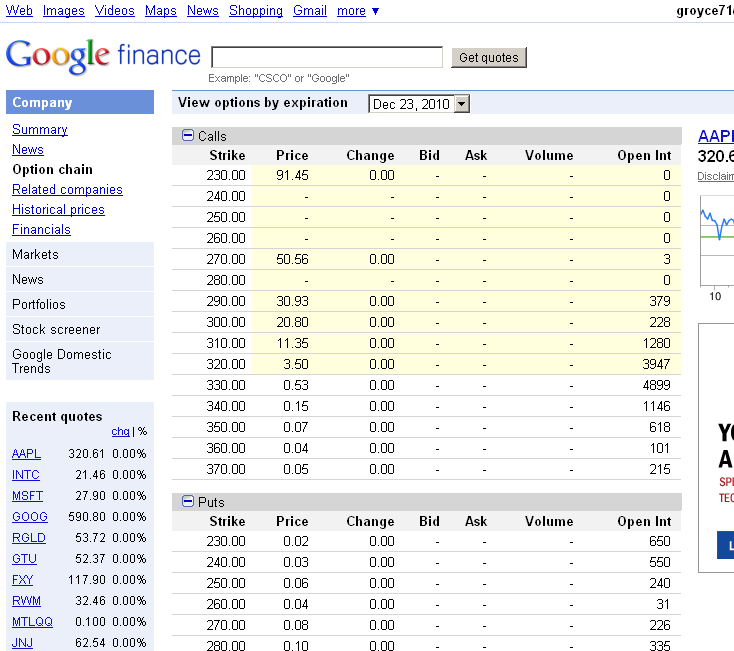

Option Chain

For example, a put option buyer is bearish on the underlying stock and believes its market forex helsinki keskusta will fall below the specified strike price on or before a specified date.

On the other hand, an option writer who shorts a put option believes the underlying stock's price will increase about a specified price on or before the expiration date. If the underlying stock's price closes above the specified strike price on the expiration date, the put option writer's maximum profit is achieved. Conversely, a put option holder would only benefit from a fall in the underlying stock's price below the strike price. If the underlying stock's price falls below the strike price, the put option writer is obligated to purchase shares of the underlying stock at the strike price.

Put Option Explained | Online Option Trading Guide

Want to know more about options? Forget The Stop, You've Got Options and Getting Acquainted With Options Trading. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Stock Option Writer Writing An Option Allocation Notice Covered Writer Premium Income Strike Price Naked Writer Pin Risk. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.