Stock options ifrs vs gaap

GAAP, ASC is the primary source of guidance on employers' accounting for employee stock ownership plans ESOPs.

Although employees can obtain stock through ESOPs from their employers as compensation for services, the equity instruments held by an ESOP were specifically excluded from the accounting requirements within ASC Therefore, entities should account for their ESOP arrangements using the guidance provided in ASC , not ASC Under IFRSs, IFRS 2 , Share-based Payment , is the primary source of guidance on accounting for all share-based plans, including ESOPs.

Entities should note that the model underlying ESOP accounting in ASC is different from that used for other share-based payment arrangements. GAAP and IFRSs, share-based payment arrangements are accounted for using a "modified grant date" model. Under this model, the compensation cost is measured at fair value as of the grant date and is recognized over the requisite service period generally the vesting period.

The compensation cost is adjusted for awards that do not vest. Under ASC , ESOP awards are not accounted for as share-based payment awards using a modified grant date model but rather are considered defined contribution plans.

ASC distinguishes between plans in which the ESOP borrowed money to acquire the employer shares i. Under a leveraged ESOP, the shares would be considered "suspense shares" when they are issued to the ESOP, and are recorded as outstanding shares in equity, offset by a charge to "unearned ESOP shares," a contra-equity account. Then, as the debt is paid down, these suspense shares are released from the suspense account and allocated to individual participant accounts.

Under a nonleveraged ESOP, the shares or cash are contributed directly to the ESOP and allocated to individual participant accounts. Some ESOPs are "pension reversion" ESOPs, in which an asset reversion from a terminated defined benefit pension plan is transferred to an ESOP.

If the assets are used by the ESOP to purchase employer shares, the issuance of shares to the ESOP should be recognized when it occurs, with a corresponding charge to unearned ESOP shares, if appropriate.

Because the models used to account for ESOPs under U.

Employee stock ownership plans — Key differences between U.S. GAAP and IFRSs

GAAP are not the same as those under IFRSs, the accounting will be different. The table below summarizes these differences and is followed by a detailed explanation of each difference. Shares in leveraged ESOPs are measured at the fair value as of the dates the shares are committed to be released to participant accounts.

Shares in nonleveraged ESOPs are measured at fair value as of the dates the shares are contributed to or committed to be contributed to the ESOP. ASC provides specific guidance on how leveraged and nonleveraged ESOP shares should be accounted for in the earnings per share calculation. No specific guidance is provided on the treatment of shares held by an ESOP. Treatment for calculating earnings per share is consistent with other share-based payment plans. GAAP, the value of the ESOP shares is measured when the shares are committed to be released.

For leveraged ESOPs, on the dates that the shares are committed to be released to the participant accounts, the compensation cost is measured at the fair values of these shares. Since the shares generally are deemed to be committed to be released ratably during an accounting period as employees perform services, the average fair values of the shares during the period are used to determine the amount of compensation cost to be recorded over the reporting period.

For nonleveraged ESOPs, the shares or cash contributed to the ESOP are deemed to directly compensate the employees because the ESOP does not have a further obligation before it may commit to the release of the shares or cash to the participant accounts.

Therefore, compensation cost is recognized at the fair value of the shares or cash contributed or committed to be contributed. GAAP, the concept of vesting for ESOPs is not taken into consideration to attribute compensation cost to the services performed. The compensation cost for leveraged and nonleveraged ESOPs is not attributed over the period that certain vesting conditions are expected to be satisfied.

IFRS 2 Share-Based PaymentRather, for leveraged ESOPs, in the period the ESOP shares have been committed to be released, the compensation cost is recognized ratably over the accounting period as employees perform the services in accordance with ASC For nonleveraged ESOPs, the compensation cost recorded is equal to the contribution made in the period as required under the plan in accordance with ASC Under IFRSs, vesting is an important consideration in the accounting of shares held by an ESOP.

Under IFRS 2, compensation cost is recognized when the goods or services have been received by the entity. Vesting conditions must be satisfied for the employee to be entitled to the shares since these conditions determine whether the services have been received by the entity.

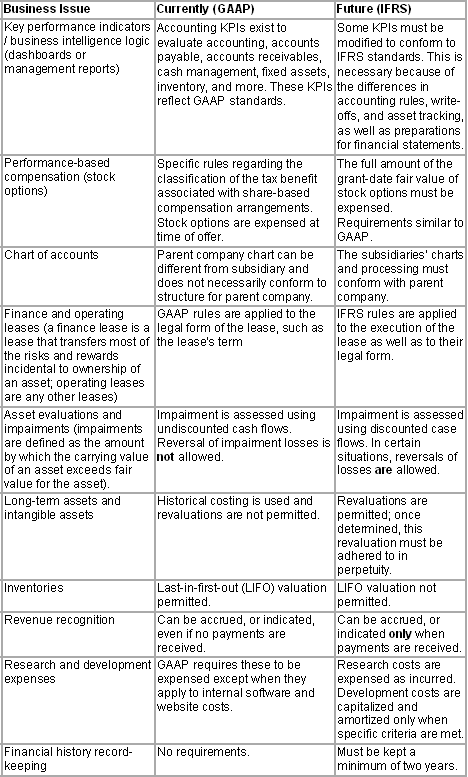

IFRS vs. GAAP

According to the vesting condition guidance in paragraphs 19 and 20 of IFRS 2, service conditions or performance conditions determine the number of equity instruments that eventually vest. For instruments that are not expected to vest, no compensation cost is recognized.

These vesting conditions may also directly specify or indicate the period over which compensation cost is recognized. GAAP, ASC contains specific guidance regarding the effect of ESOP shares on the earnings per share calculation. For leveraged ESOPs, ASC states that "shares that have been committed to be released shall be considered outstanding. Shares held by a pension reversion ESOP are not treated as outstanding until they are committed to be released for allocation to participant accounts.

Special rules apply to employers with ESOPs that hold convertible preferred stock. IAS 33 , Earnings per Share , provides the primary guidance on earnings per share under IFRSs.

It specifies that since shares held by ESOPs are considered share-based payment arrangements, the treatment for calculating earnings per share is consistent with that applied to other share-based payment awards.

GAAP and IFRSs and do not necessarily include interpretations of such literature. See Legal for additional copyright and other legal information. DTTL and each of its member firms are legally separate and independent entities. Certain services may not be available to attest clients under the rules and regulations of public accounting.

These words serve as exceptions. Once entered, they are only hyphenated at the specified hyphenation points. Each word should be on a separate line.

The full functionality of our site is not supported on your browser version, or you may have 'compatibility mode' selected. Please turn off compatibility mode, upgrade your browser to at least Internet Explorer 9, or try using another browser such as Google Chrome or Mozilla Firefox.

What is the accounting treatment for unusual or infrequent items for IFRS and U.S. GAAP? | Investopedia

Login or Register Deloitte User? Login Login Name Password Login Register Forgot password. Welcome My account Logout. Navigation Key Differences Between U. About Contact us Legal Privacy. Correction list for hyphenation These words serve as exceptions. English Universal English British English American Deutsch. Vesting of the shares is not taken into consideration in the recognition of compensation cost.

Vesting is important in determining the period over which compensation cost is recognized.