Speculation in stock market examples

Lawrence Mitchell has previously received funding from the Alfred P. Sloan Foundation and Ford Foundation to present conferences and other academic events. Reproduisez nos articles gratuitement, sur papier ou en ligne, en utilisant notre licence Creative Commons.

There is no question that speculation caused the financial crisis of , first in housing, and then in derivative securities. Recent reports on the multiple advantages enjoyed by high-speed traders again brings speculation to the fore and, with it, the question of whether it is good, bad or indifferent for the economy. Rather, it is one of those things that we know when we see.

What is a speculative investment? Definition and meaning - Market Business News

In order to evaluate speculation, we must first understand what we mean by it. The definition of speculation has shifted over time, at least with respect to financial markets. At the end of the 19th century, speculation generally meant investing in companies for which you had little or no information.

Within a decade, the more common usage was investing in securities where dividends were uncertain.

What is Speculation in Stocks?This meant common and, to some extent, preferred stock. Since all dividends are discretionary, all forms of stock were considered speculative. And dividends were important because it was to get those — not capital gains — that people bought stock. Matters changed starting in the s. The move from dividends to capital gains had begun in earnest.

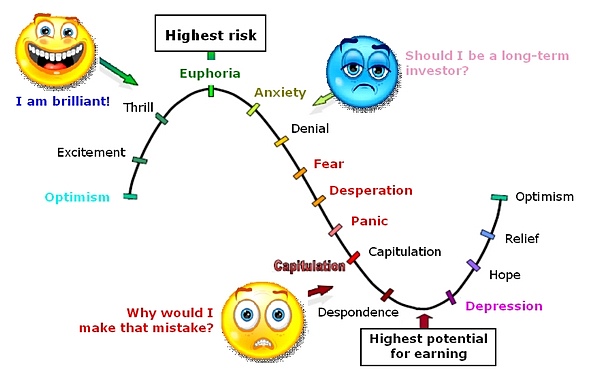

Speculation now meant investing in the hope of capital appreciation — that is, selling to somebody for a higher price than you paid.

This meant that a share of stock was worth what you paid for it. That was investing, not speculating. Cold hard realities have brought this belief into serious question. There is less doubt about the speculative nature of derivative securities that began to develop in the s and exploded at the turn of the 21st century. Think of the shape of a tornado. The productive asset — the asset that generated the revenue to pay the claims — was a point at the bottom.

As claims proliferated from that point up, they expanded higher and higher, wider and wider, far beyond the capacity of the energy at the bottom — the earnings — to sustain it. When investors at the top woke up and realized this, they started massive selloffs — and the whole structure came crashing down.

Another way of looking at this is as a Ponzi scheme. It carries the patina of investment legitimacy because, unlike a classic Ponzi scheme, there is some source of earnings. But those earnings are so inadequate to support the securities superstructure that a Ponzi scheme is an appropriate metaphor. The logical conclusion based on this definition is that speculation is never good, at least in the sense that it never contributes to the productive economy.

The principle negative economic effect of speculation is to divert resources away from production and into the speculative casino. After all, we allow gambling. Where it becomes bad is when it causes damage to the rest of the economy.

And that occurs when speculation becomes parasitic on the productive economy. Here are a few examples of that happening.

What is speculation? definition and meaning - husoxupowoj.web.fc2.com

Stock bubbles are speculative. It is unlikely the underlying corporations could earn anywhere near enough money to justify prices in any reasonable time frame.

That makes them speculative. Stockholders, however, expect management to sustain or increase prices. This puts pressure on managers to manage for the short-term, damaging the long-term prospects of the productive asset — the underlying corporation.

Mortgage-backed securities provide another example.

The concept behind them is legitimate. Commercial banks are limited in the amounts they can lend based upon their capital reserves and the risk of the loans they already have made. When banks sell off some of their risk — as they do in the case of mortgage-backed securities — the amounts of money they are able to lend increases. So it is with other asset-backed instruments — car loans, consumer loans and the like.

Stock market index - Wikipedia

These assets, when kept within reason, are not speculative, because their return depends upon earnings from the underlying asset. And this behavior is good for the economy because it allows banks to lend more money in the productive economy. When it becomes bad — when it becomes speculation — is when ever-increasing sums of money are invested in derivative products promising substantial returns that are not supported by the actual underlying earnings.

At this point, money that could be invested in the productive economy is diverted to the purely derivative economy — the speculation economy — where it continues to recirculate until the inevitable crash. Speculation has been, and always will be, with us, whether in financial markets or otherwise, the Dodd-Frank Act notwithstanding.

So we would do well to impose some restraints. There are a number of ways we can control speculation, or at least keep it within bounds that might diminish its harm. Changing accounting rules so that cash flow becomes more important than earnings per share is another strategy that would significantly reduce the opportunities for creative bookkeeping.

It would also help to ensure that the underlying value of the asset can support the returns of the investment securities based on it. There are many more ways to help prevent good speculation from becoming parasitic, but these suggestions are, I hope, a good start. Auteur Lawrence Mitchell Professor of Law, Case Western Reserve University. Trading floors like this one — at the old American Stock Exchange in the s — are at the heart of capitalism and financial speculation.

The tulip mania in the Netherlands in the s is often considered this first recorded speculative bubble.

What is Speculation in the Stock Market? | husoxupowoj.web.fc2.com

The price of tulip bulbs surged in value then suddenly collapsed. An economic parasite Here are a few examples of that happening. Part-time employment will likely still be concentrated in industries such as accommodation and food services in the future.

Children marching on the anniversary of the Soweto uprising. Fed Chair Janet Yellen speaks at a press conference following the rate-hike decision. Big data, big money: