Forex cci indicator

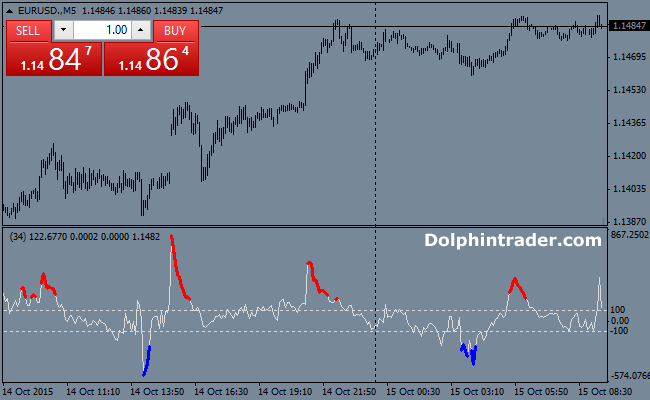

Follow us on Twitter: Absolutely NO THINKING is needed, just buy when Blue and sell when Red! The Commodity Channel Index CCI Indicator was developed by Donald Lambert, and is a traditional technical indicator.

It is based on the average of the deviation between the Moving Average and the Typical Price Average of high, low and close.

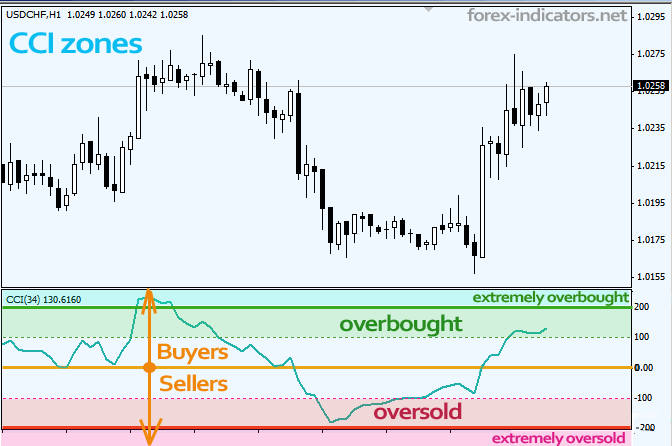

It is commonly used to identify periods where price is overbought and oversold - where the price is far from the Moving Average. It is also use to gauge trend direction by looking if it is positive or negative. Calculation The CCI is calculated in the following way: Calculate a bars Simple Moving Average of the Typical Price.

Calculate the Mean Deviation of Typical Price and SMA of TP for the bars. Apply the following formula: Practically, the CCI gives a numerical representation of standard deviation of price from its Simple Moving Average. Smaller CCI values indicate that price is closer to its Moving Average, and bigger CCI forex cci indicator indicate that price is more distant than its Moving Average. Woodies CCI Zero-Line-Reject A method that incorporates the CCI Indicator is Woodies CCI, developed by Ken Wood.

He trades the CCI by trading several patterns that occurs on it.

How do I use Commodity Channel Index (CCI) when creating a forex trading strategy? | Investopedia

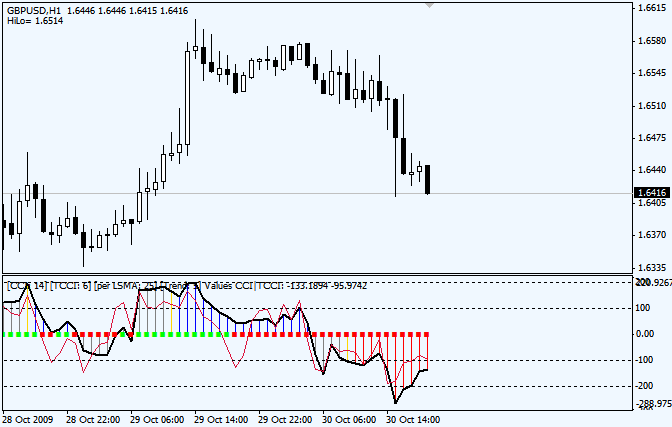

One pattern traded is automated binary options trading system que Zero-Line-Reject.

It happens when CCI becomes close to its zero line, but bounces back to its previous direction. This pattern is actually parallel to the price getting closer to a moving forex cci indicator - and bouncing from it.

This is the logic behind the entry - Moving Average that serves as support area. This is a highly powerful method that provides strong entry signals. However, it is usually more profitable to trade it using the Vfx trading system Average itself, rather than by the CCI. By trading with the Moving Average the trader can judge the trend's strength by looking at the slope of the MA.

This allows for more reliable signals and filters ranging periods. Zero-Line Cross This is a simple method of trading with the CCI indicator, which is based on the Zero-line. Its rules are the following:. Buy when CCI crosses its zero-line from below.

Sell when CCI crosses its zero-line from above. Trend-Line Break This method is also a part of the Woodies CCI method.

It is also used on other indicators, such as the Momentum. Its basis is the breakout of trendlines that are seen on the chart of the CCI.

Hughes Optioneering

Once trendline is identified, trader enters the trade after it is broken by price. Click here for more information. CLICK to see PROOF!

Trade Forex With The CCI Indicator

Advertise with Us Disclaimer. Home Page Articles MetaTrader Indicators Traditional Indicators. Primary links Home Page Articles MetaTrader Indicators Traditional Indicators.

Its rules are the following: