Employee stock options for unlisted companies

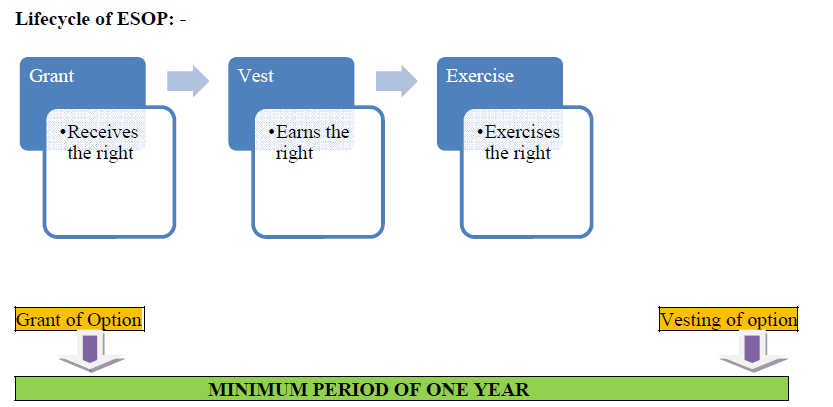

Many companies in India offer ESOPs to their employees. This basically means that the employee has the option to purchase stock of the company at a future date at a pre-determined price.

Employees typically have to wait for a certain duration known as vesting period before they can exercise the right to purchase the shares.

Nevada Corporations. Incorporate in Nevada. Nevada Incorporation

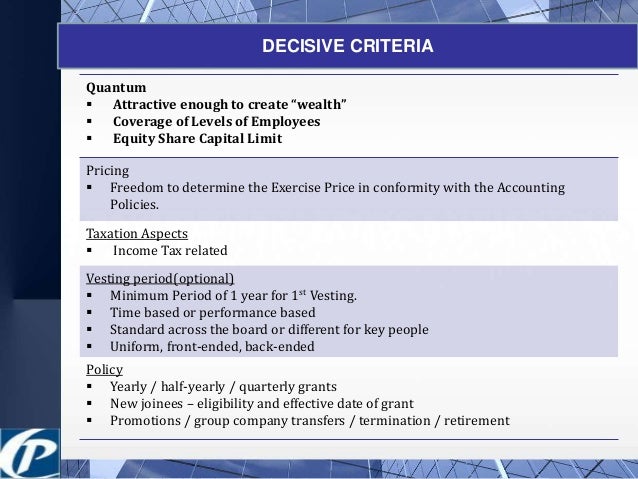

This article simplifies the basic concepts of ESOP and various statutory obligations attached to it. ESOP gives an employee the option to buy a certain number of shares of the company at a pre-decided price, which usually is a discounted price. An option is first granted to an employee and after a specific period when exercised vests with the employee.

TalkShoe - Unlisted Call

This period is referred to as the vesting period. Direct Route and Trust Route are two routes through which the Company may implement the ESOP scheme.

Under the direct route fresh allotments of the equity shares of the company are made to employees, as and when they exercise the options. Whereas under trust route the Company forms an employee welfare trust for administration of the ESOP wherein the Company issues shares to the trust for onward transfer to the Employees upon exercise of Options.

Many small sized organisations prefer to have the direct route whereas large organizations mainly listed companies prefer to set up a Trust.

Many Companies used to follow trust route to purchase and sell its share from secondary market however from January SEBI has restrained trust of listed companies to buy shares from secondary market.

Many Indian companies, including Infosys Limited, have used trust route to implement ESOP scheme.

Stock Market Terms - Stock Market Vocabulary: Glossary of Terms | TMXmoney

It is recognised as employee compensation expenses over the requisite service period with a corresponding credit to Employee stock option outstanding account which is part of shareholder equity. The accounting value is determined by finding either fair value of the option or intrinsic value of the option. Taxation of ESOPs in India has witnessed continuous change.

Up to the financial year ending March , there was no specific provision for taxing the benefits arising from ESOPs.

The ESOPs were generally taxed as a perquisite in the hands of the employees on the difference between the FMV of the stock on the date of vesting of the options and the exercise price. Subsequently, there was a concessional tax treatment for ESOPs, which were designed in accordance with prescribed ESOP Guidelines.

Post that an employer was required to pay Fringe Benefit Tax FBT on benefit derived by an employee from ESOPs. At the time of allotment, difference between fair market value of shares on date of exercise of option and actual exercise price is taxed as perquisite.

Employee Stock Options: Comparisons To Listed Options

In addition, the difference between the sale consideration of the shares and the FMV on the date of exercise is chargeable to tax under the head capital gains in the hands of an employee. Income Tax Act does not specify any method for computation of FMV of shares and provides that for the purpose of perquisite valuation the FMV of ESOP shall be such value as determined by a merchant banker on the specified date.

Till issuance of RBI recent circular in July , method for valuation for tax purposes and under RBI regulation was not in sync as DCF method was prescribed by RBI for valuation whereas no such method was prescribed under income tax. However with amendment, RBI has authorised merchant bankers to determine value as per internationally accepted methodology. Prior to enchantment of new Companies Act , there were no regulations specified for ESOP.

However Companies Act has specified framework related to ESOP for unlisted Companies. Now Companies would need to comply with the disclosure and other requirements specified in this regard. In order to retain the human capital, companies in India are investing a lot of money these days and ESOP has become an important medium to motivate the employee. Companies offer shares as an employee benefit and as a deferred compensation.

The structure of ESOP plans is largely driven by respective local tax laws and regulations. For increased transparency many countries have introduced or are contemplating introduction of more stringent regulations.

In spite of increased scrutiny, equity plans still remain a key part of executive remuneration packages and their global spread is likely to continue. As attractive ESOPs may seem for employees, any time new shares are issued, the stock of existing owners is diluted. That dilution must be weighed against the tax and motivation benefits an ESOP can provide. Finally, ESOPs will improve corporate performance only if combined with opportunities for employees to participate in decisions affecting their work.

Click here to cancel reply.

Web Design India Internet. Your browser is ancient! Upgrade to a different browser or install Google Chrome Frame to experience this site. ESOP — Concept ESOP gives an employee the option to buy a certain number of shares of the company at a pre-decided price, which usually is a discounted price.

ESOPs — Tax implications Taxation of ESOPs in India has witnessed continuous change. ESOP regulations under Companies Act Prior to enchantment of new Companies Act , there were no regulations specified for ESOP. Conclusion In order to retain the human capital, companies in India are investing a lot of money these days and ESOP has become an important medium to motivate the employee. Archives April February October August March February October September March September August